Online Insurance Adjuster License Training – Start Your Claims Adjuster Career Today

Get Your Insurance Adjuster License Online – Texas, Florida, & Nationwide Reciprocity Courses Available

Start your career with trusted, online claims adjuster training from 2021 Training. Whether you’re pursuing your Texas All-Lines Adjuster License or the Florida Insurance Adjuster License, our online programs make it easy, affordable, and fast.

Hear What Our Students Say

Take The First Step to Become an Insurance Adjuster Today

Becoming an insurance adjuster is easier than you think, and 2021 Training offers step-by-step guides and courses to help you accomplish your goals. Your new career is just around the corner, sign up today and get started! Contact Us Today or see how our Frequently Asked Questions can help you.

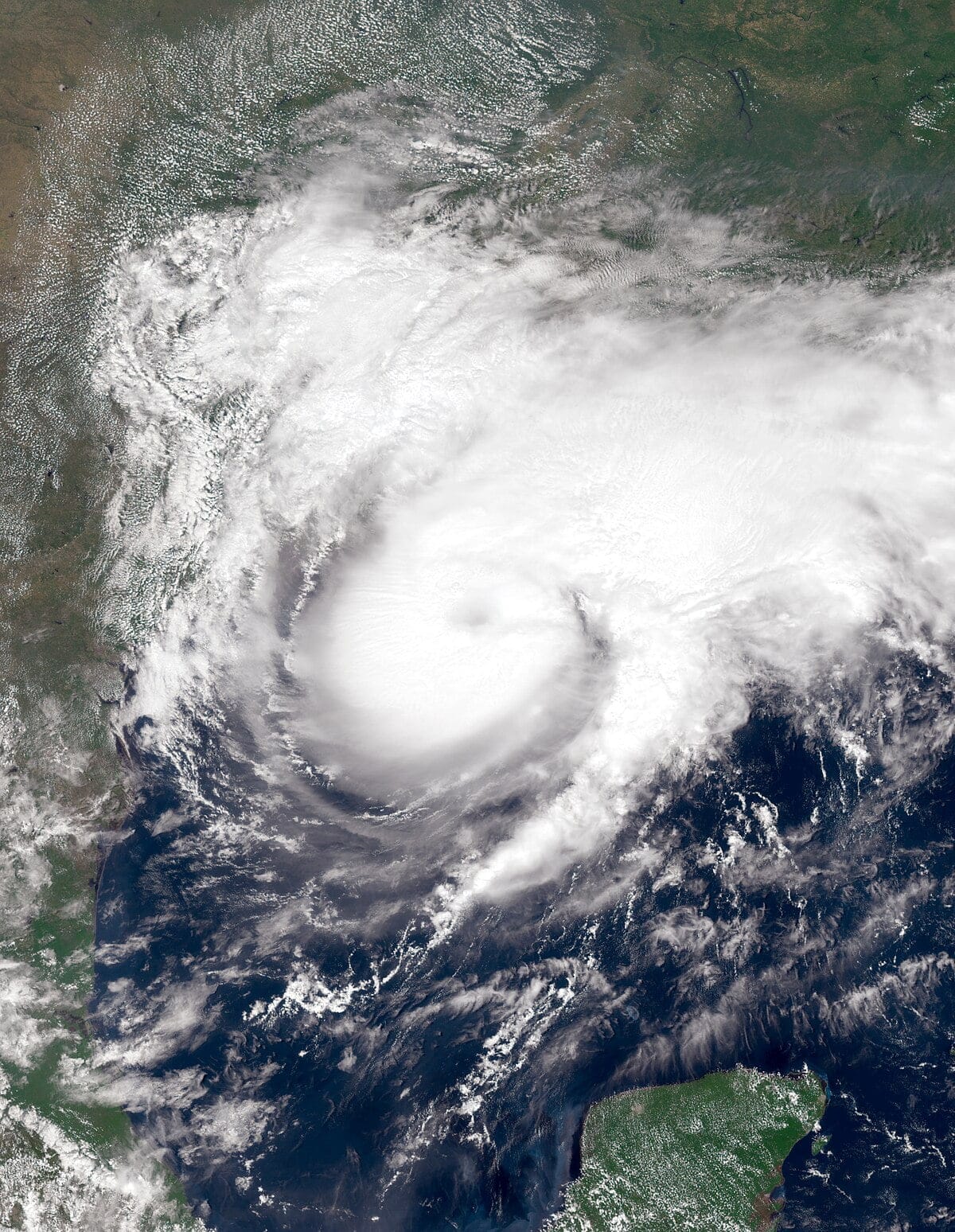

Get Ready For The Next Big Storm

We’ve lowered our prices to make it easier for you to get licensed and start helping those affected by the storms. Take advantage of hurricane season savings now to begin your career and assist those who are facing the aftermath of severe weather.

Texas

Florida

Texas Pricing

Good

This Texas Insurance Claims Adjuster License course allows you to adjust all claims with the Texas All-Lines License.Better

The 3-course Smart Start Package includes Texas Insurance Claims Adjuster Licensing for the Texas All Lines License, Xactimate training, and Practical Adjusting.Best

The 4-course Smart Start + Package is our best value and includes Texas Insurance Claims Adjuster Licensing for the Texas All Lines License, Xactimate training, Practical Adjusting, and Basics of Construction.Texas CE Package A

This package satisfies the 24-hour CE requirement for your Texas insurance license and includes the following individual courses: Ethics for Insurance Professionals (1 hr., #108270), Ethical Principles (2 hrs., #112746), Landlord and Homeowners Insurance Policies (6 hrs., #81087), Other Types of Insurance—Farm, Crop, Flood, etc. (8 hrs., #91088), and Understanding Commercial Insurance and Coverage (7 hrs., #106289).Texas CE Package B

This package satisfies the 24-hour CE requirement for your Texas insurance license and includes the following individual courses: Ethics for Insurance Professionals (1 hr., #108270), Ethical Principles (2 hrs., #112746), Licensing and Regulations for Adjusters (3 hrs., #91170), Other Types of Insurance—Farm, Crop, Flood, etc. (8 hrs., #91088), Settling Property Losses (3 hrs., #91168), and Understanding Commercial Insurance and Coverage (7 hrs., #106289).Florida Pricing

Good

This Florida Insurance Claims Adjuster Licensing course allows you to adjust all claims. This one contains everything you need to get your Florida Adjuster License.Better

The 3-course Smart Start Package includes Florida All-Lines Pre-Licensing, Xactimate training, and Practical Adjusting.Best

The 4-course Smart Start + Package is our best value and includes Florida All-Lines Pre-Licensing, Xactimate training, Practical Adjusting, and Basics of Construction.Xactimate Software Training

Adjuster Concepts and Ethics Through XactimateThis is the easiest Xactimate training you will find. Prepare yourself to be proficient in writing claims in Xactimate®. This course will take you from an absolute beginner walking your way through writing your first complete claim.

Practical Adjusting

Practical AdjustingThis course is packed with practical information and insider tips that you can only get from someone who’s been in the field. You will learn how to find your first job as an insurance claims adjuster, how alert levels affect employment opportunity, and tools of the trade.

About Us

Real World Insurance Adjuster Training

Our experienced adjusters make your licensing journey easy as 1-2-3.

2021 Training was founded with one purpose in mind: to train new insurance adjusters in a way that would prepare them for the real-world challenges they would face, in a convenient online format. Even down to Continuing Education for years to come, we’ve got you.

To make your research a bit easier, we’ve compiled some of the most commonly asked questions that we get from prospective students who hope to become successful insurance adjusters. Check out the guide to get all of the information you need to get started.

Texas Online Insurance Adjuster Training

We make getting licensed easy. Embark on your journey to a rewarding career in insurance claims adjusting with 2021 Training’s Texas Smart Start Package. Our online classes provide a comprehensive and affordable solution to obtaining your Texas insurance adjusting license. For only $408, the Texas Smart Start Package equips you with all the essential skills and knowledge required to kickstart your new career. This bundle, meticulously designed by 2021 Training, addresses the crucial aspects of insurance adjusting, ensuring you’re well-prepared for success.

With a commitment to saving you money and providing a solid foundation, this package includes the Texas All-Lines Pre-Licensing Course, Xactimate Training Course, and Practical Adjusting Course – a combination that not only saves you $99 but also sets you on the right path to a fulfilling career in insurance adjusting. Join 2021 Training and launch your adjusting career the smart way!

Gain all the knowledge and skills needed to begin your new adjuster career today.

Florida Online Insurance Adjuster Training

2021 Training offers the easiest way to get your Florida Insurance Adjuster License Online, including the Florida Public Adjuster License. Our course offers you a designation which will exempt you from any other testing or requirements. Florida Insurance Adjuster Licensing has never been easier. Simply sign up to take our online course and pass our online exam. This will get you everything you need to apply to the state for your Florida Insurance Adjuster License.

Embark on a fulfilling career in insurance adjusting with 2021 Training’s Florida Smart Start Package. Our three-course online bundle is strategically crafted to save you money on Florida insurance adjuster licensing course while addressing the fundamental aspects crucial to your success in the field. For an affordable investment of $458, the Florida Smart Start Package equips you with the skills and knowledge needed to launch your adjusting career the right way.

This comprehensive Florida insurance adjuster licensing package is tailored for anyone entering the world of insurance adjusting, offering the Florida Insurance Adjuster Pre-Licensing Course to secure your adjuster license. Additionally, our Xactimate® Training Course ensures you become proficient in writing claims, giving you a competitive edge in the industry. What sets us apart is our commitment to providing insider tips that most adjusters won’t have, empowering you to understand how to be an adjuster and create your own system for success. Join 2021 Training, invest wisely, and pave the way for a successful career as a Florida insurance adjuster.

For residents of Colorado, District of Columbia (Washington D.C.) , Illinois, Kansas, Maryland, Missouri, Nebraska, New Jersey, North Dakota, Ohio, Pennsylvania, South Dakota, Tennessee, Virginia, and Wisconsin, claim Texas or Florida as your “home state” and you too use our packages for Online Insurance Adjuster Licensing and begin a new career today! Here is a guide detailing more information about insurance adjuster license state reciprocity.

Latest From The Blog

Hurricane Milton: A Call for Insurance Adjusters to Step In

Hurricane Helene on the Gulf Coast

Tropical Storm Francine

Affordable Insurance Adjusting Training from 2021 Training

We have streamlined the licensing process to make it easy for you to start your new career as a licensed insurance adjuster in Texas or Florida.

Our courses go beyond the ordinary, employing humor, true stories, word pictures, and slide shows to make the training vivid and lively. Dave and our instructors share valuable tips and practical information, making your learning journey more than just a classroom experience—it’s a preparation for a successful career.

Embarking on a new career with us is simple. Claim residency in Texas or a state without licensing for insurance adjusters, take our state-certified Texas All-Lines Pre-Licensing Course, pass the final exam, complete the required fingerprints, and submit your online application to the Texas Department of Insurance. The low barrier to entry, coupled with our comprehensive training, ensures that you can step confidently into your first field job. Join 2021 Training today and let us guide you toward a rewarding career in insurance adjusting.